Importance Of Financial Planning

This article will explore the importance of financial planning opportunities, unravel the significance and benefits, and debunk common misconceptions. So, buckle up as we navigate the world of fiscal wisdom and equip you with the tools to shape a prosperous tomorrow.

Understanding Financial Planning

Financial planning is managing your finances to help you achieve your financial goals. These goals could include buying a house, paying for your children’s education, saving for retirement, or travelling the world. Financial planning can also prepare you for unexpected events such as illness, job loss, or home repairs. By having a solid financial plan in place, you can feel more confident about your future and better equipped to handle any challenges that may come your way.

Defining Financial Planning

Financial planning resembles plotting a journey for your finances, involving a structured method to attain life goals. It entails assessing your current financial state, establishing achievable objectives, and creating a financial stability and prosperity roadmap.

Core Components of Financial Planning

Financial planning comprises several essential components:

- Budgeting,

- Saving,

- Investing,

- Retirement planning, and

- Risk management.

Each element is pivotal in fortifying your financial fortress, ensuring resilience against unforeseen adversities.

The Benefits of Financial Planning

Embracing financial planning creates a fortress of stability around your finances, shielding you from the upheavals of economic uncertainties. By meticulously orchestrating your monetary affairs, you pave the path towards fiscal resilience and tranquillity.

Gateway to Goal Achievement

The importance of financial planning serves as the key to unlocking the doors of your dreams and aspirations. Whether purchasing your dream home, travelling the world or retiring comfortably, a well-crafted financial plan empowers you to turn aspirations into reality.

Common Misconceptions About Financial Planning

1. The Myth: Financial Planning is Only for the Wealthy

Financial planning is created for more than just the rich and famous, as many people believe. It is a practical approach that anyone can use, regardless of income level or background. Whether you’re a seasoned investor or a novice saver, financial planning caters to everyone’s economic aspirations.

2. Myth: Financial Planning is Complex and Time-Consuming

While financial planning may seem daunting at first glance, it’s not an insurmountable mountain. With proper guidance and resources, anyone can start their financial planning journey. It’s essential to remember that building a solid financial plan takes time; after all, Rome wasn’t built in a day.

Tools for Financial Empowerment

Empower yourself with the essential tools and resources to navigate the labyrinth of financial planning effectively. From budgeting apps like Moneybox and YNAB to retirement calculators such as Personal Capital and Fidelity, arm yourself with the arsenal of economic prowess. Other budget planners include:

- Monese

- Revolut

- Starling Bank – Mobile Banking

- Monzo – Mobile Banking

- TopCashBack

Financial Planning Calculator

Fidelity Retirement Calculator: The Fidelity retirement calculator is an indispensable tool for estimating retirement expenses, analysing savings goals, and charting a course towards retirement readiness.

Related articles:

How To Make Money Blogging Fast

Blogging For Beginners Are You Thinking Of Starting A Blog

How To Make Money Through Blogging

Unlock Your Financial Planning Dreams

Setting Financial Goals

Anchoring your financial voyage begins with setting clear and achievable goals. Whether buying a home, saving for your children’s education, or retiring comfortably, delineate your objectives precisely.

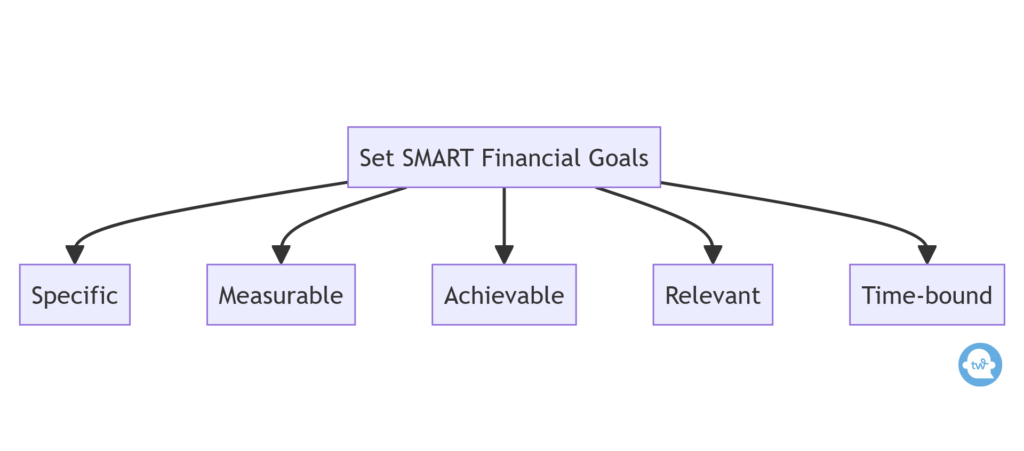

SMART Goals

Adopt the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—to frame your financial aspirations. SMART goals are the guiding stars, illuminating the path towards financial fruition.

Assessing Your Current Financial Situation

Navigating the Fiscal Landscape

Embark on a voyage to navigate the intricate contours of your financial landscape. Assess your income streams, scrutinise your expenses, evaluate your assets, and confront your liabilities head-on.

Cash Flow and Net Worth

It’s important to carefully scrutinise your earnings and expenditures to evaluate your net worth. By analysing the ebb and flow of your income and expenses, you can unravel the health of your finances and make informed decisions about your future expenditure. Understanding the dynamics of your financial tides can help you plan for the future and ensure your long-term financial stability.

Creating a Budget

Blueprint for Financial Success

The art of budgeting can help you create a blueprint for financial success. It is the foundation of financial stability and enables you to align your spending with your priorities and aspirations.

Practical Steps

- Track Your Expenses: Monitor your spending habits, identifying areas for optimisation and savings.

- Set Realistic Limits: Establish realistic spending limits for various categories, ensuring fiscal discipline and prudence.

- Embrace Flexibility: Embrace flexibility in your budgeting approach, accommodating unforeseen expenses and fluctuations.

Saving and Emergency Funds

Building Resilience

In the face of uncertainties, fortify your financial fortress with the bulwark of savings and emergency funds. These financial cushions serve as a lifeline during turbulent times, offering solace and security amidst storms.

Strategies for Building an Emergency Fund

- Automate Savings: Set up automatic transfers to designated savings accounts, ensuring a consistent inflow of funds.

- Prioritise Saving: Prioritise savings over discretionary spending, allocating a portion of your income towards emergency reserves.

- Start Small, Grow Big: Begin with modest contributions and gradually ramp up your savings rate as your financial situation improves.

Investment Strategies

Embark on a journey of wealth accumulation through prudent investment strategies. Explore the myriad avenues to nurture your financial garden, from stocks and bonds to real estate and mutual funds.

Principles of Diversification and Risk Management

- Diversification: It is advisable to diversify your investments across different asset classes and sectors to minimise risks and increase the resilience of your portfolio.

- Risk Management: Assess your risk tolerance and investment horizon, aligning your portfolio with your financial objectives and comfort level.

Retirement Planning

Charting a Course for Retirement

Chart a course towards retirement bliss by embracing early retirement planning. Whether through UK employer-sponsored plans such as workplace pension schemes, or individual retirement accounts such as the personal pension plans or self-invested personal pensions (SIPPs)., seize the reins of your retirement destiny.

The Power of Early Planning

Starting your financial planning journey early gives you more time to benefit from the power of compounding, which allows you to accumulate wealth gradually and steadily over time.

Guidance and Resources

- Workplace Pension Scheme: Workplace pension schemes in the UK are retirement savings plans employers establish for their employees. These schemes are designed to help individuals save for retirement and typically involve employer and employee contributions. Employees contribute a portion of their salary to the pension scheme, which is then invested on their behalf to grow over time. The UK government has introduced automatic enrollment legislation, requiring employers to enrol eligible workers into a workplace pension scheme and contribute to it.

- Personal Pension Plans: In the United Kingdom, people can independently establish personal pension plans to save for their retirement. These plans are retirement savings accounts that individuals themselves can set up. The primary purpose of these plans is to help people save money for their retirement years. These plans allow individuals to make contributions from their earnings, and they often come with tax benefits, such as tax relief on donations.

- Self-Invested Personal Pensions (SIPPs): are personal pension plans that offer individuals greater flexibility and control over their investments. With SIPPs, individuals can choose from various investment options, including stocks, bonds, mutual funds, and property. Individuals can customise their pension investments based on their financial goals and willingness to take risks. This adaptability enables people to mould their investments better to suit their needs.

Addressing Common Doubts

Embarking on the financial planning journey often entails grappling with doubts and uncertainties. However, remember that it is often said that every journey begins with a single step. So, with the proper guidance and determination, you can surmount any obstacles.

Seek professional financial advice

Harnessing Expertise

Professional financial advisors bring a wealth of knowledge, expertise, and experience, offering tailored solutions and strategic insights to optimise your financial journey.

Regularly review and adjust your financial plan.

As life progresses, your financial requirements and objectives may shift. It’s crucial to periodically assess and modify your financial plan to remain on course. This allows you to stay attuned to shifts in the market and your financial position.

Ways to reduce expenses and increase savings.

- Embrace Frugality: Adopt a frugal mindset, distinguishing between needs and wants and trimming unnecessary expenses to bolster your savings.

- Automate Savings: To ensure a disciplined approach towards saving, you can set up automated transfers to your savings accounts. This will help you automate your savings process and maintain consistency in your savings.

Ways to diversify your investment portfolio.

- Explore Asset Classes: Consider looking into alternative investments, such as real estate, commodities, and peer-to-peer lending, in addition to traditional stocks and bonds.

- Utilise Investment Vehicles: Leverage diversified investment vehicles like index funds, exchange-traded funds (ETFs), and mutual funds to spread risk and enhance portfolio resilience.

Ways to stay motivated and disciplined in financial planning.

- Visualise Your Goals: Create a vision board or visual reminders of your financial goals, fueling your motivation and commitment to financial success.

- Celebrate Milestones: Celebrate small victories along your financial journey, acknowledging your progress and reinforcing positive financial habits.

Methods for tracking expenses and managing cash flow.

- Budgeting Apps: Harness the power of budgeting apps like Mint, YNAB, and Personal Capital to track expenses, categorise transactions, and gain insights into your cash flow.

- Expense Tracking Spreadsheets: Create customised expense tracking spreadsheets using tools like Microsoft Excel or Google Sheets, providing a granular view of your financial inflows and outflows.

Methods for minimising taxes through strategic financial planning.

- Tax-Efficient Investing: Opt for tax-efficient investment strategies such as investing in retirement accounts, harvesting tax loss, and maximising tax-advantaged investment vehicles.

- Strategic Asset Location: Strategically allocate assets across taxable and tax-advantaged accounts to optimise tax efficiency and minimise tax liabilities.

Methods for protecting your assets and mitigating risks.

- Insurance Coverage: Safeguard your assets and mitigate risks through comprehensive insurance coverage, including life insurance, health insurance, and property insurance.

- Estate Planning: Establishing an estate plan that includes wills, powers of attorney and trusts is essential to help you protect your assets and ensure a smooth inheritance transfer to the next generation.

Conclusion

Congratulations on starting your journey towards financial planning! With the information, knowledge, and strategies provided, you now possess the necessary tools to manoeuvre the intricate world of finance and strive towards a prosperous and secure future.

It is important to remember that achieving financial success depends on where you end up, not just how you get there. So, embrace the process, take control of your financial future, and set a course towards a brighter tomorrow!

FAQ

What is the best age to start financial planning?

Financial planning knows no age boundaries. Whether in your 20s, 30s, or beyond, it’s never too early to embark on your financial planning journey.

How do I prioritise my financial goals?

Prioritise your financial goals based on their urgency, significance, and long-term impact. Align your goals with your values and aspirations, ensuring they resonate with your financial vision.

Can you start financial planning with limited income?

Absolutely! Financial planning is not contingent upon the size of your paycheck. Regardless of your income level, embracing financial planning empowers you to optimise your resources, prioritise your goals, and navigate the path towards economic prosperity.

Is it possible to recover from financial setbacks through planning?

Indeed, financial setbacks are not the end of the road but mere detours in your financial journey. Through prudent planning, resilience, and perseverance, individuals can bounce back from financial adversities, emerging stronger and wiser.

Can I DIY my financial planning, or should I hire a professional?

While DIY financial planning is feasible for some individuals, seeking professional guidance can offer invaluable insights and expertise, especially when navigating complex financial terrain.

How often should I review and update my financial plan?

Regularly review, eat, and adapt your financial plan to fit into your life changes, financial milestones, and market fluctuations. Aim for an annual review or whenever significant life events occur.

Is it possible to recover financially after bankruptcy?

Despite the financial setback of bankruptcy, individuals can embark on a path towards economic recovery through diligent budgeting, rebuilding credit, and adopting prudent financial habits.

Why You Should I start Financial Planning Now?

Starting financial planning as early as possible ensures financial stability and avoids difficulties. The statement “Why you should start financial planning early” highlights the importance of initiating financial planning early. Remember to plan your finances early to ensure a secure financial future.